With the cost of living skyrocketing, find out how women can grow their pension to close the Gender Pension Gap.

In 2022 more women than men will be affected by the cost-of-living crisis, as more women work part-time; they hold 60% of below-living wage jobs. The Office for National Statistics reveals that the gender pay gap for full-time employees in April 2022 was 8.3%, up from 7.7% in April 2021 and down from 9.0% in April 2019 (pre-COVID-19).

Lower pay means essential costs are a higher proportion of outgoings, as those on lower salaries still pay the same for food, energy, accommodation, car insurance etc. Further price rises, especially for energy, now mean that basic living costs are exceeding earnings for some. Not only this, but lower wages mean that there remains a difference in pension savings known as the Gender Pension Gap.

The gap exists at every age, but it is most noticeable when a person retires, as many women leave the workforce with significantly less money than their male counterparts. With private pensions specifically, the median pension wealth of men (£315,300) is nearly double that of women (£157,900).

How the gender pay gap affects pensions

Penfold’s data reveals that the average pension pot value of a male is 22% bigger than a female, with £1209 more saved on average.

Employers are key in closing the Gender Pay Gap with a responsibility towards improving women’s retirement prospects. If there’s no change, women could be disadvantaged, having fewer freedoms and options as they approach and enter what could be a less comfortable retirement.

The gender pay gap does not appear to be narrowing as 2023 approaches.

Penfold’s reveals that women tend to favour less risky investments, with their female savers showing a preference for safer and more ethical investing. However, choosing a pension plan with a higher percentage of volatile investments, such as equities and shares, offers more opportunity for pension growth. These higher-risk investments have historically provided higher returns than ‘safer’ investment strategies because they have a longer time to weather any short-term losses.

Here are some helpful tips from Penfold’s on building a successful pension pot for women:

Building a successful pension pot as a woman

The earlier you begin making payments into your pension, the more you’ll be able to benefit from compound interest’s beneficial effects as it builds up over time. It doesn’t matter if you can only make small payments. Create a monthly payment plan for your pension now, and as your income increases in the future, you can increase it.

1. Consistent contributions

Unexpected life costs and occurrences are common but can completely throw off the balance of your financial goals. Don’t worry if your contributions are lower than in past years but continue to put something away and aim to increase the amount the following year.

2. Consider higher-risk options

While some investors favour low-risk investments that track inflation, others are willing to try higher-risk options for a more significant gain. It’s important to remember that investments with higher risk levels will probably fluctuate in value over time, potentially going from higher to lower value more frequently. As a result, you are solely responsible for your investment strategy. To attain your target of a million pounds in pension savings, it may be worth considering allocating a more significant portion of your investment portfolio to riskier products if you begin saving for retirement later in life.

3. Combine pension funds

Check the origins of all your previous pensions and reclaim any misplaced persons if you want to amass a sizeable retirement fund. It may be worth combining them all into a single, user-friendly account.

4. Consider the effect of career breaks

Many women take a career break for maternity leave or reduce their working hours to care for children. This can impact women’s pension pots by the end of their careers.

You may not only have to deal with a pay gap, but your long-term professional prospects could also suffer. An earnings gap might decrease your pension benefits, including state and private/workplace pensions.

Penfold discovered that if a woman pauses her pension contributions at a certain age, they stand to lose money on their final pot value*:

- Age 25 – £10,851

- Age 35 – £8,453

- Age 45 – £6584

- Age 55 – £5,129

Saving into a pension during any maternity leave can be a solution; however, if money is tight, it’s important to consider the impact on the final pot value before making any decisions.

*Based on £250 monthly contribution, one year pause in monthly contributions, medium growth rate (5% per annum) and a retirement age of 68.

You may be interested in…

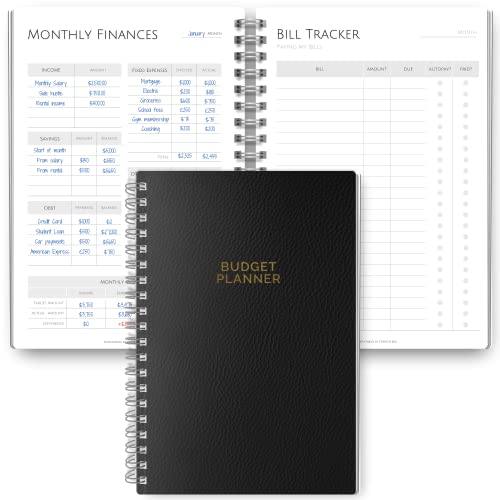

Best-selling financial planners

Stuck for inspiration? Check out our list of best-selling Amazon products!

- Annual Budget Planner

- Annual Finance Tracker

- Income & Expense Tracker

- THE ULTIMATE COMPACT BUDGET BOOK – Clever Fox Budget Book combines a compact format, effective budgeting tools, and premium-quality materials to make personal finance management effective and...

- PLAN & MONITOR YOUR MONTHLY SPENDING – Each month, make a monthly budget, set goals, plan upcoming bills, purchases, and income. Use a dedicated expense tracker to track your day-to-day spending....

- TRACK SAVINGS, BILLS & DEBT PAYOFFS – The budgeting planner includes 8 saving and 8 debt trackers, and a regular bill tracker to help you plan and monitor your finances in more detail.

- ✅ 12 FULL MONTHS TO TRACK!: The WallDeca budget planner has 12 complete months that can budget track for 1 year. Each month can be customized to the date and time when you track. tart budgeting and...

- ✅ BUDGET FINANCE MANAGEMENT: The WallDeca budget planner and accounts book lets you keep track of all your financial transactions in one place. This feature helps you stay organized and manage your...

- ✅ EXPENSE TRACKING: An expense tracker notebook allows you to record all of your daily expenses in one place. This feature is especially useful for identifying areas where you may be overspending...

- Falkenberg, Camilla (Author)

- English (Publication Language)

- 224 Pages - 01/04/2024 (Publication Date) - DK (Publisher)

- MANAGE YOUR MONEY EFFECTIVELY - This budget planner contains financial goals, financial strategy, savings, debts, daily expense, monthly budget, monthly budget review, Christmas budget, summary of the...

- UNDATED & 12 MONTH USE - Undated finance books start with 1 page for financial goals, 1 page for financial strategy, 4 pages for saving tracker, 4 pages for debt tracker, followed by 12 months(10...

- MONTHLY GOALS , BUDGET & REVIEW ORGANIZED - 12 month budget planner helps you to set monthly goals, budget, review, and develop monthly habits, monetary strategies & action plans well. Write down...

Last update on 2024-03-28 / Affiliate links / Images from Amazon Product Advertising API

This article may include affiliate links to products and services where we may receive a small fee to support the running of this site if you make a purchase or is a sponsored article from one of our select editorial partners providing valuable advice and information to our readers.